Key Features

Flexibility

Freely configurable billing models tailored to the diverse needs of lawyers and their clients.

Automation

Automatic generation of financial documents and payment monitoring to increase work efficiency.

Analytics

Advanced financial reports enabling informed business decision-making in your law firm.

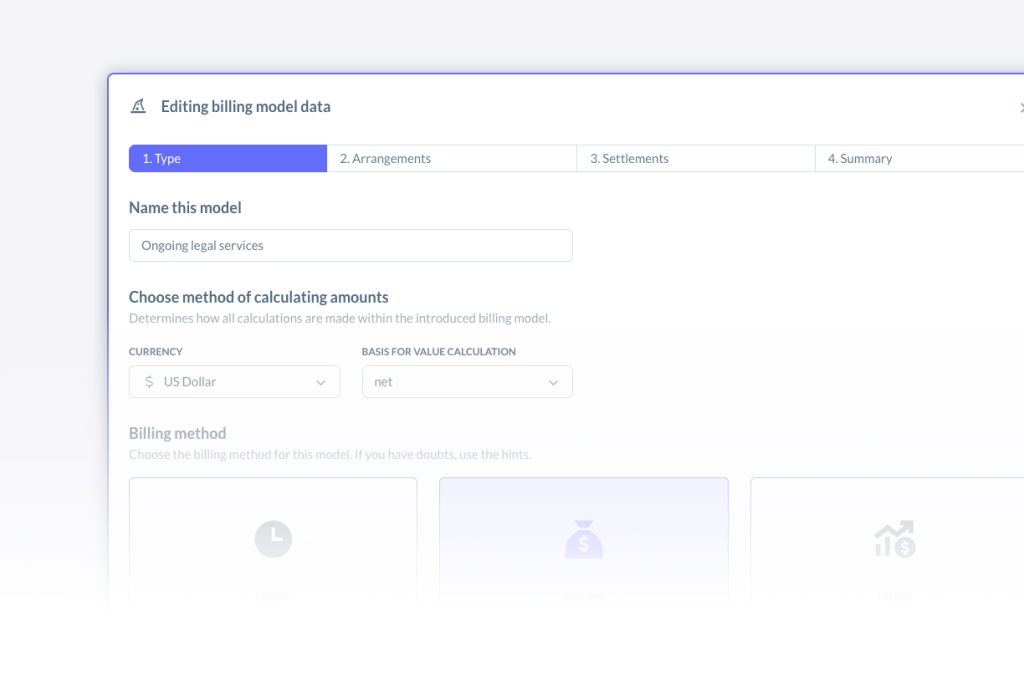

Flexible Billing Models Tailored to Your Needs

In the WOLF4® system, you can utilize various billing models with clients. Each project can be billed according to different rates – flat fee, hourly, mixed, or by stage.

Diverse Billing Models

Ability to bill each project in different ways: flat fee, hourly, mixed, or by stage, with different rates for various types of work.

Advanced Invoice Structure

One invoice represents one agreement, but each item on the invoice can come from a different billing model, providing complete flexibility.

Additional Charges

Automatic rate increases depending on services performed, type of work, or service package sold to the client.

Multi-currency Support

Settlements in different currencies with the option to set fixed or variable exchange rates, with final settlement in local currency.

Financial Analytics and Budgeting

The WOLF4® accounting module allows for advanced financial analysis. Monitor client work time utilization in real-time, compare costs incurred with revenues, and track activities that don’t have an assigned billing model.

The system automatically summarizes activities from a given billing period, making it easy to issue invoices and work reports.

Additionally, you can plan budgets for individual departments, define analytics areas, and track budget implementation progress based on costs incurred and sales invoices.

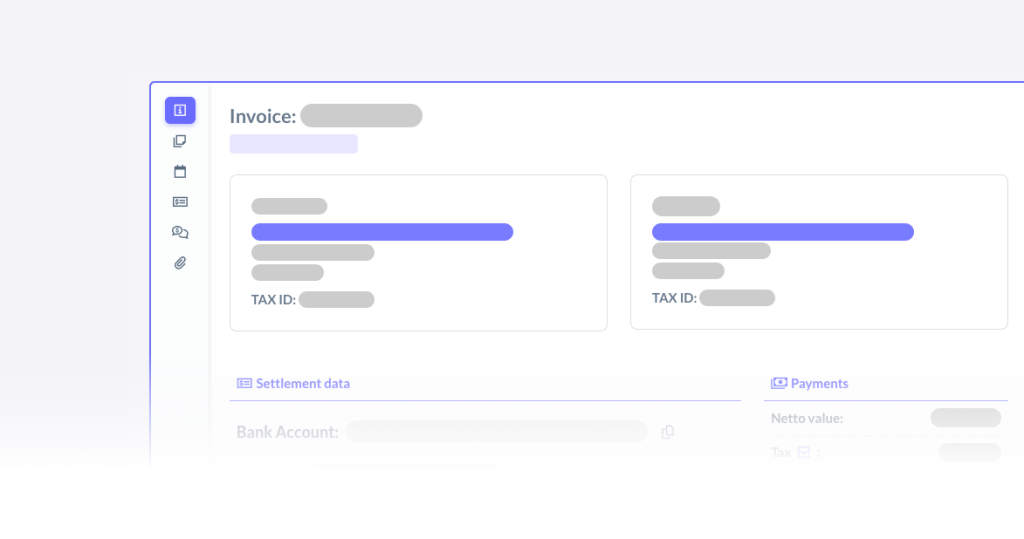

Advanced Payment and Collection Options

WOLF4® supports various settlement methods – use virtual accounts, online payments, or generate transfers for expense invoices.

With the mass collection service, you can assign each client an individual bank account and automatically settle payments. The system also handles cash settlements, currency conversions, and refunds of overpayments.

In case of payment deadline violations, you can automatically generate payment reminders and pre-litigation notices, as well as maintain a complete collection report, analyzing debt repayment.